Get a better job

Curious about careers and their growth potential? Want to sharpen your skills before applying to a program? Whether you’re looking for an entry-level job or career advancement, this is the place to get started.

Explore jobs in growing fields

Discover Classes: An On-Ramp to PCC

Are you interested in learning about training options for healthcare or manufacturing? We are here to help you explore options, make a plan, and take the next step! Our non-credit, no-cost Discover Classes are open to all.

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online yes

- OMIC yes

Career Exploration Workshop Series

If you’re thinking about becoming a PCC student but aren’t sure which path to take, this series of workshops will help you identify your skills, explore in-demand jobs, and create your career plan.

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online yes

Steps to Success (for TANF recipients only)

Programs and services for individuals currently receiving Temporary Assistance for Needy Families (TANF). Services are available in Washington TANF services and Multnomah TANF services counties.

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online yes

NextGen Youth Services

The NextGen program provides a welcoming and supportive space for youth (ages 16–24) to explore careers, develop skills and work experience, and make a smooth transition to postsecondary education and successful careers.

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online yes

Programs for immigrants, refugees, and non-native English speakers

We offer services to help you explore career and education opportunities, practice your English and learn new skills! These programs are specific to our immigrant and refugee community. Learn about our Explore Career and College class, and more.

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online yes

Connect with an employer

WorkSource

Our WorkSource team offers courses, tools, and services to help improve your skills in today’s competitive job market.

Location:

- 42nd Avenue no

- Willow Creek yes

- Online yes

Build your skills

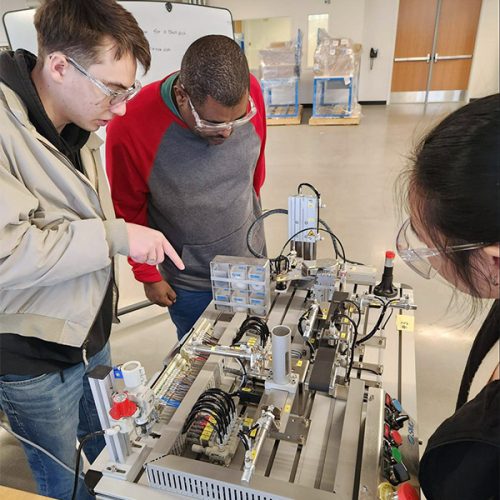

Quick Start Semiconductor Technician Training

Learn the skills you need to get hired in one of Oregon’s fastest growing industries – in just 10 days.

Location:

- 42nd Avenue no

- Willow Creek yes

- Online no

![]()

Semiconductor Essentials Training (SET)

Are you 17-24 years old and interested in the semiconductor industry? Start your journey with SET at no cost to you! Join this class to:

- Plan your next steps of study at PCC

- Develop technical skills through hands-on training

- Develop in-demand essential skills for success

Location:

- 42nd Avenue no

- Willow Creek yes

- Online no

Workforce Navigator / Employment and Training Advisor

Mulu Terefe, our local Workforce Navigator / Employment and Training Advisor, helps people brush up on their résumé skills, connect with job opportunities, learn how to develop the skills needed by today’s employers, and more. Make your appointment today!

Contact Mulu: mterefe@pcc.edu, 971-722-2140 (office), 503-969-2769 (cell)

Location:

- 42nd Avenue yes

- Willow Creek no

- Online no

Computer Basics

This workshop is offered monthly at each Opportunity Center. You’ll learn about a new topic every month such as computer and internet basics, Microsoft basics, Google Workspace basics, and Google Docs and Sheets. Build your confidence and sign up at no cost! English language learners of all levels are welcome!

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online no

Start a business

Small Business Development Center

Our Small Business Development Center (SBDC) will help you launch or grow your small business through no-cost, one-on-one business advising, and affordable business education.

Location:

- 42nd Avenue yes

- Willow Creek yes

- Online no