Spend less, save more

Now that you’ve tracked your expenses, you can figure out what you do without. Look at each expense to determine if it is a need or a want.

- A need is something that you can’t do without – like having a place to live or food to eat.

- A want is something that you would like to have but could do without, for instance, cable TV, upgrading your cell phone, or eating at restaurants.

There are some easy ways to reduce your wants: eat at home, get rid of cable, or do without a new phone. More difficult changes might also be necessary, like moving to a less expensive apartment or trading in your car for a cheaper model. Making the harder choices can be easier when you put them in context with your goals: will this expense today support my goals tomorrow?

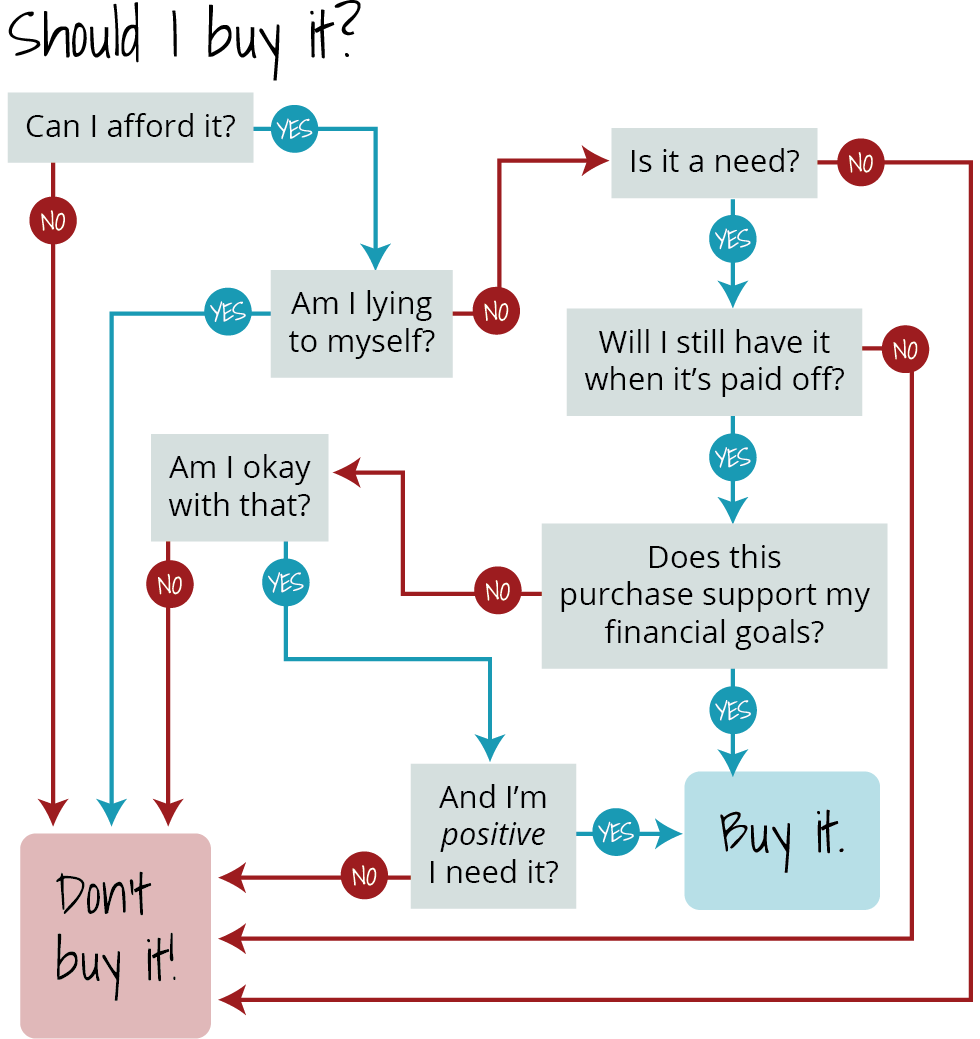

Should I buy it: text version

When thinking about buying something, make sure you can answer yes to all the following questions:

- Can I afford it? Yes.

- Am I being honest with myself? Yes

- Is it a need? Yes.

- Will I still have it when it’s paid off? Yes.

- Does this purchase support my financial goals? Yes.

- If it doesn’t support your goals, am I okay with that? Yes.

- And you’re positive you need it? Yes.

Increase your flow

If you have cut costs as far as you can and your income still does not meet your needs, it’s time to increase your incoming flow of money.

Ideas for bringing in more cash:

- Get a second job. Think of something you are already good at: see jobs for students.

- Find a better-paying job. You may need to adjust your college schedule to do this which means it might take a little longer to graduate. If that’s the case, try and find work that is closely related to your intended career after college. This will help you make connections in your chosen career field and you may even be able to use your experience as credits for your degree program.

- Sell some items you no longer need or use, take on a roommate if you have extra space, or find someone who wants to carpool with you to work or school and chip in for gas and parking.

- Access to community resources such as food stamps may help you temporarily to balance your spending plan. Prosperity Planner from WorkSource Oregon will help you determine if there are resources in state or federal programs that you might be eligible for.

Food

If you’re experiencing food insecurity, ASPCC can help! Check out one of the Panther Pantries which are run by students for students. Emergency bus tickets, hygiene packs, and other supplies are also available to students. See what’s available: Panther Pantry.

Ways to save money

- Many instructors are adopting Open Educational Resources, which are resources shared freely on the web, instead of traditional textbooks to save students money and more effectively serve teaching and learning. You can search the schedule to find low and no-cost material classes.

- As a student, you are eligible for student discounts on computer hardware and software, public transit passes, and even things like movie tickets. Try asking “Do you offer a student discount?” at all the places you shop.

- You can ride the PCC shuttle for free, go to ASPCC events (which often have free food), and get help through PCC Tutoring. And don’t forget that you are allocated the equivalent of 100 double-sided pages per term for free.

- As a student, you can get a discounted TriMet student pass.

- Other cool resources you can check out are Sylvania’s Dental Clinic, bike rentals at Southeast and Cascade, and all the different Clubs and Resource Centers. See what’s available: Student Life.

Get $3 for every $1 you save

If you are saving for college, you should look into setting up an Education Individual Development Account (IDA). These accounts will match your savings – this means that they will contribute $3 for every $1 you put in your savings account! In case you can’t tell, that’s an amazing deal.

IDAs are offered by community-based organizations. To get started, take the IDA Eligibility Quiz, then contact one of the organizations listed to find out how to apply.