Financial Operations and Planning Manager

Class: Management | Exempt status: Exempt | Grade: L

The Financial Operations & Planning Manager provides operational direction, strategic guidance and accountability for the Academic Affairs and/or Student Affairs division on decisions that drive overall financial and business success. This position supports a broad range of day-to-day and long-term financial matters for Academic Affairs and/or Student Affairs, including those of significant complexity. The incumbent provides leadership and expertise in the development and monitoring of financial budgets and strategies and the development and management of systems and practices which ensure compliance and the consistent application of related policies and procedures. The Financial Operations & Planning Manager serves as liaison between Financial Services and assigned functional area to facilitate training and communication and oversees the coordination and implementation of financial processes. This role analyzes and provides guidance on operations to ensure best financial practices are integrated and recommends changes to increase effectiveness.

The Financial Operations & Planning Manager provides operational direction, strategic guidance and accountability for the Academic Affairs and/or Student Affairs division on decisions that drive overall financial and business success. This position supports a broad range of day-to-day and long-term financial matters for Academic Affairs and/or Student Affairs, including those of significant complexity. The incumbent provides leadership and expertise in the development and monitoring of financial budgets and strategies and the development and management of systems and practices which ensure compliance and the consistent application of related policies and procedures. The Financial Operations & Planning Manager serves as liaison between Financial Services and assigned functional area to facilitate training and communication and oversees the coordination and implementation of financial processes. This role analyzes and provides guidance on operations to ensure best financial practices are integrated and recommends changes to increase effectiveness.

Leadership competencies

- Advances Racial and Social Justice

Actively works toward the elimination of racism and social oppression; utilizes culturally responsive practices and processes to achieve equitable student and employee outcomes - Drives Vision and Purpose

Participates in the creation of and executes a vision for the College’s mission balancing compliance with flexible, multimodal, inclusive delivery of financial services. - Drives Engagement

Initiates and drives authentic exploration and engagement cross-departmentally to arrive at collaborative solutions that lead to employee and student success. - Accelerates Agility and Innovation

Analyzes systems, policies and practices and commits to continuous program improvement through the strategic use of culturally responsive data. - Builds Partnerships

Partners to solve problems, adapts communication and approaches, supports healthy conflict, and develops strong relationships with associated areas to advance institutional goals.

Our mission

To support student success by delivering access to quality education while advancing economic development and promoting sustainability in a collaborative culture of diversity, equity, and inclusion.

Our vision for equitable student success

Recognizing the unique value, perspectives, strengths, and challenges of every person who comes to PCC for education, all students will achieve their academic goals through equitable support, quality instruction, clear guidance to persist, and an unwavering commitment to completion shared by the entire College community.

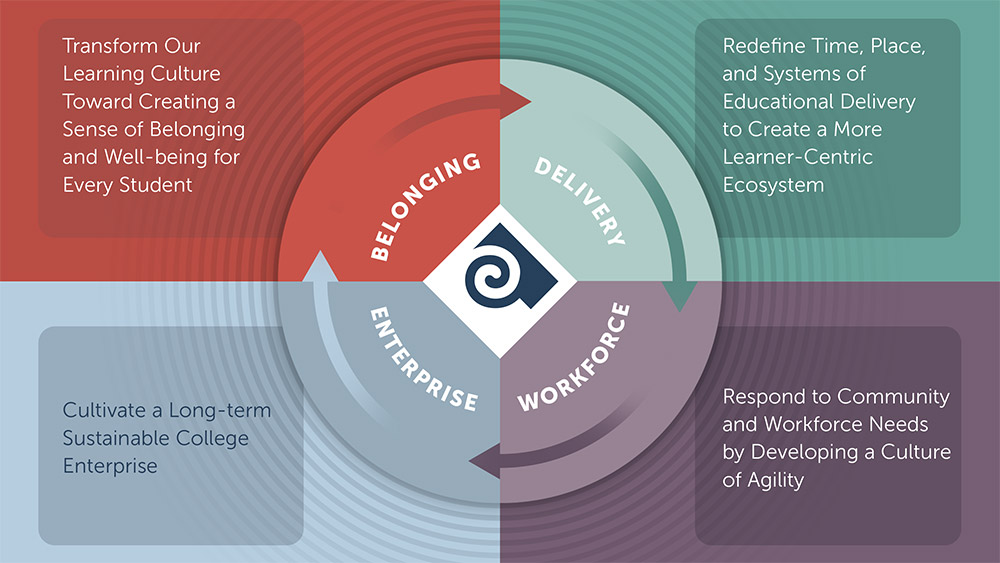

Yes to Equitable Student Success (YESS)

Our roadmap to dismantling barriers and building inclusive systems of education and support.

Typical Duties and Responsibilities

- Supports the strategic direction and operations of the Academic Affairs or Student Affairs division by providing financial and budgetary guidance to the assigned functional area. Serves as a primary contact and administrative resource for Financial Services and assigned area and communicates information on available resources, services, updates, changes, and deadlines, and ensures division compliance.

- Forecasts and develops financial business models, initiatives and plans in alignment with the College strategic plan in a culturally responsive manner. Establishes metrics, monitors and coordinates items related to budgets and new and ongoing programs, initiatives, services or facilities. Performs financial and cost analyses and forecasts including enrollment monitoring and projections to inform revenue forecasting.

- Create and implement budget reports using and ERP system or supplemental budget software.

- Supervises academic professionals, classified, technical/support, and/or student staff. Reinforces staff’s development of PCC’s leadership competencies. Evaluates, supports, and provides guidance on professional development plans and goals for assigned areas of responsibility in accordance with practices, policies, and collective bargaining agreements. Hires, evaluates, trains, disciplines and recommends dismissal of staff as necessary.

- Provides direction and support to staff while overseeing and problem-solving financial planning and reporting activities within Academic Affairs or Student Affairs. Creates and/or reviews budget reports and updates and utilizes budget monitoring tools on behalf of assigned functional area. Monitors and analyzes expenditures and journal vouchers.

- Builds and maintains partnerships and engages key stakeholders to develop collaborative cross-functional and cross-departmental teams. Directs, reviews, and guides Academic Affairs and Student Affairs leadership teams through Financial Services related processes and requirements.

- Represents Financial Services business operations in engagements and decision making, including Budget, Student Accounts, Accounts Receivable, Contracts and Grants Office, and Procurement & Contract Services in meetings and planning sessions.

- Creates and administers program, pathway, division, and fund budgets in assigned areas of responsibility; coordinates the allocation of resources following budget approval and organizational strategic initiatives; recommends approval of expenditures and expenditure plans for assigned functional area.

- Responsible for area specific duties such as overseeing student and course fees, monitoring revenue and class costs including sponsored grant-funded courses and course fee waivers; provides guidance on fees and funds, and analyzes fees and pricing in collaboration with management; administration of the Faculty Sabbatical program; monitoring metrics, outcomes and revenue related to Strategic Enrollment Management; providing guidance on the Student Activity Fee and Student Activity Fund in collaboration with District Student Council and on other related programs and projects.

- Develops, monitors, and improves financial processes, procedures, workflow, and/or standards, ensuring alignment with College mission, values, goals and objectives. Ensures compliance with approved policies, procedures, processes, and local, state, and federal laws and regulations.

- Researches, analyzes, interprets and administers operational policies, procedures, and processes in support of Financial Services and Academic Affairs and Student Affairs operations.

- Ensures compliance with Procurement & Contract Services rules for purchase card, direct pays, requisitions, and contracts. Facilitates and oversees contracts and purchasing and coordinates with Procurement & Contract Services for process clarification and questions.

- Recommends, implements and supports technology to support financial activities of the supported area(s).

- In concert with finance information and technology staff and the Budget Office implement and/or maintain supplemental finance budget software to generate cost analysis, cost of service and budget reports.

- Participates in/on a variety of meetings, committees, and/or other related groups to communicate information regarding programs, information resources, services, and/or other pertinent information as appropriate.

- Positions in this classification may perform all or some of the responsibilities above and all positions perform other related duties as assigned.

Work Environment

Work environment includes frequent disruptions and changes in priorities. Work is generally performed in an office environment with frequent interruptions and irregularities in the work schedule. Working hours may vary and occasional evening or weekend work is required. Frequent travel to other locations is required. No special coordination beyond that used for normal mobility and handling of everyday objects and materials is needed to perform the job satisfactorily.

Minimum Qualifications

Bachelor’s Degree in Accounting, Finance, or Business Administration, or related area AND five (5) years of progressively responsible professional-level related experience including two (2) years of financial program management or supervisory experience.

OR Bachelor’s Degree in any field AND seven (7) years of progressively responsible professional-level related experience including two (2) years of financial program management or supervisory experience.

OR nine (9) years of progressively responsible professional-level related experience including two (2) years of financial program management or supervisory experience.

Knowledge, Skills, and Abilities

Knowledge of:

- Supervisory principles;

- Budgeting and Financial principles and practices;

- Advanced financial analysis, forecasting, principles and methods;

- Applicable federal, state, and local laws, rules, regulations, and ordinances;

- Non-profit/College fund accounting systems and principles;

- Advanced internal control practices;

- Research methods and techniques;

- Automated financial systems;

- Community college operations and administration principles and practices;

- Policy and procedure development and implementation practices.

Skills in:

- Supervising and providing leadership to staff;

- Perform or create data analytics including reports and dashboards to forecast or query financial transactions and program activities;

- Cost analysis of revenue and expenditures to support different services levels;

- Fostering open and inclusive communication among various stakeholder groups and at varying levels of the organization;

- Coordinating activities with other internal departments in a matrix structure;

- Developing, implementing and monitoring budgets and operational models;

- Interpreting and applying applicable Federal, State, and/or Local laws, rules, and regulations;

- Evaluating complex financial systems and efficiently formulating and installing project management methods, procedures, forms, and records;

- Technical financial report writing using ERP and Software applications or tools;

- Working with diverse academic, cultural and ethnic backgrounds of community college students and staff.

Ability to:

- Lead cross-functional and cross-departmental teams;

- Provide high level financial analysis;

- Prepare complex financial statements, reports, and analyses;

- Develop and enforce finance and accounting procedures and principles;

- Analyze and interpret complex financial and accounting information;

- Design and implement finance, budgeting, accounting and recordkeeping systems;

- Plan and organize work and manage projects;

- Prepare a variety of reports related to operational activities, including statistical analysis;

- Monitor compliance with applicable policies, procedures, rules, and regulations;

- Utilize computer technology for communication, data gathering and reporting activities;

- Communicate effectively through oral and written mediums, including training of staff.

Revised: 3/2023

New 7/2021

Portland Community College is committed to hiring and retaining a diverse workforce. We are an Equal Opportunity Employer, making decisions without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disability, or any other protected class.