Financial Services Manager I

Class: Management | Exempt status: Exempt | Grade: J

Under the direction of management, the Financial Services Manager I manages the day-to-day operations of an assigned financial services functional area. Participates in the recommendation and administration of operational policies, procedures and processes in support of assigned functional area. Responds to inquiries from College departments and/or external agencies and supervises administrative services professionals, paraprofessionals, technical/support staff, and/or student workers.

Under the direction of management, the Financial Services Manager I manages the day-to-day operations of an assigned financial services functional area. Participates in the recommendation and administration of operational policies, procedures and processes in support of assigned functional area. Responds to inquiries from College departments and/or external agencies and supervises administrative services professionals, paraprofessionals, technical/support staff, and/or student workers.

Leadership competencies

- Advances Racial and Social Justice

Actively works toward the elimination of racism and social oppression; utilizes culturally responsive practices and processes to achieve equitable student and employee outcomes - Drives Vision and Purpose

Participates in the creation of and executes a vision for the College’s mission balancing compliance with flexible, multimodal, inclusive delivery of financial services. - Drives Engagement

Initiates and drives authentic exploration and engagement cross-departmentally to arrive at collaborative solutions that lead to employee and student success. - Accelerates Agility and Innovation

Analyzes systems, policies and practices and commits to continuous program improvement through the strategic use of culturally responsive data. - Builds Partnerships

Partners to solve problems, adapts communication and approaches, supports healthy conflict, and develops strong relationships with associated areas to advance institutional goals.

Our mission

To support student success by delivering access to quality education while advancing economic development and promoting sustainability in a collaborative culture of diversity, equity, and inclusion.

Our vision for equitable student success

Recognizing the unique value, perspectives, strengths, and challenges of every person who comes to PCC for education, all students will achieve their academic goals through equitable support, quality instruction, clear guidance to persist, and an unwavering commitment to completion shared by the entire College community.

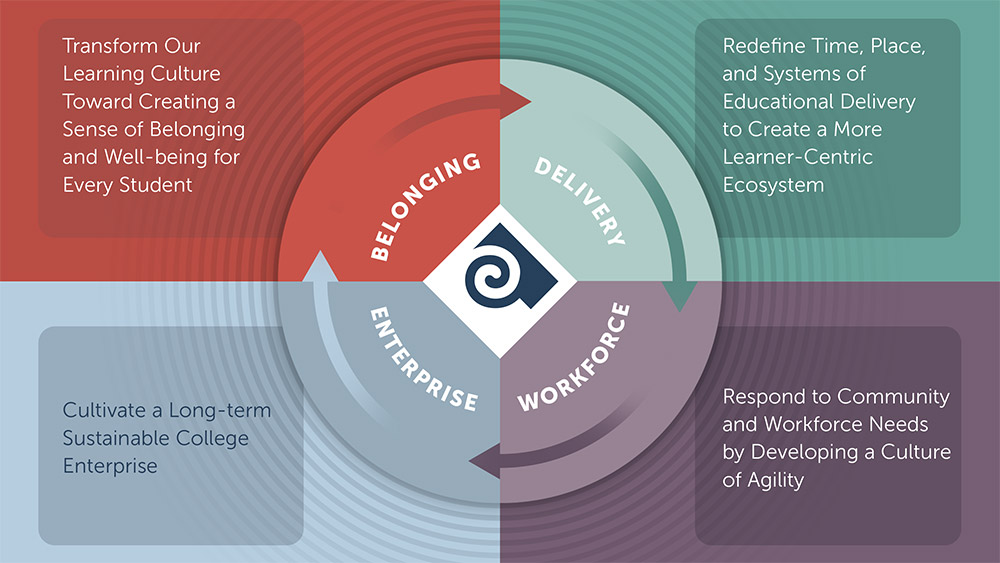

Yes to Equitable Student Success (YESS)

Our roadmap to dismantling barriers and building inclusive systems of education and support.

Typical Duties and Responsibilities

- Plans, organizes, monitors and manages the day-to-day processes and operations of an assigned functional area within the Financial Services division requiring the interpretation and application of federal and state mandated guidelines. Manages activities in assigned area of responsibility to include coordinating, implementing, administering and evaluating assigned programmatic area.

- Participates in developing, monitoring, evaluating, and recommending improvement to processes, procedures, workflow, and/or standards, ensuring alignment with College mission, values, goals and objectives and local, state, and federal laws and regulations.

- Recommends and administers operational policies, procedures, and processes in support of Financial Services operations; implements and monitors compliance with approved policies, procedures, and processes.

- May supervise administrative services professional, paraprofessional, and technical/support staff. Hires, evaluates, trains, disciplines and recommends dismissal of staff as necessary.

- Researches, analyzes, and interprets applicable laws and regulations relative to assigned area of responsibility; makes recommendations based on findings.

- Participates in/on a variety of meetings, committees, and/or other related groups to communicate information regarding programs, information resources, services, and/or other pertinent information as appropriate.

- Serves as a liaison with other internal departments within the College and/or to external agencies in order to provide information on available resources and/or services.

- Participates in the development and administration of program budget in assigned area of responsibility; coordinates the allocation of resources following budget approval; recommends approval of expenditures.

- Positions in this classification may perform all or some of the responsibilities above and all positions perform other related duties as assigned.

Position-Specific Duties and Responsibilities

Cash & Investments

Positions assigned to Cash & Investments may also be responsible for:

- Planning, organizing, monitoring, and managing the day-to-day cash flow of all College funds. Analyzing and making decisions that impact institutional cash flow to ensure that funds are optimally utilized and available for daily expenditures.

- Monitoring investment and portfolio performance and bond fund balances. Providing regular support, benchmarking, performance, and management reports and documentation on areas such as risk and compliance, sales and refunding debt issues, and bond earnings.

- Analyzing and recommending strategies for investments including bond sale proceeds; implementing portfolio analytical systems.

- Coordinating and performing accounting of investment functions in accordance with GASB standards and banking/federal regulations; completing and approving journal entries to record complex investment transactions, monthly and quarterly allocation of interest earnings, calculation of investment amortization or accretion and accruals, and portfolio valuation.

- Initiating timely electronic payment of taxes, debt service, and investment purchases. Transferring funds between College bank accounts, investment dealers, and the Local Government Investment Pool. Approving ACH and other transactions, fraudulent positive pay returns, and stop payments.

- Buying and selling investment instruments in compliance with College investment standards and ORS 294.035. Monitoring investment holdings and securities market for changes that may affect the College’s portfolio; making adjustments to enhance earnings and/or reduce risk.

Work Environment

Work is generally performed in an office environment with frequent interruptions and irregularities in the work schedule. No special coordination beyond that used for normal mobility and handling of everyday objects and materials is needed to perform the job satisfactorily.

Minimum Qualifications

Minimum qualifications may vary with professional field and legal/licensure requirements:

Bachelor’s degree in Accounting, Business Administration, Finance or related area. Relevant experience may substitute for the degree requirement on a year-for-year basis. Three (3) years progressively responsible, professional experience related to area of assignment, including once (1) year of lead or supervisory experience. Successful completion of PCC LEAD Academy or a comparable external leadership training program may substitute for up to 6 months of lead or supervisory experience.

Cash & Investments position requires: Bachelor’s degree in Accounting, Business Administration, Finance or related area. Relevant experience may substitute for the degree requirement on a year-for-year basis. Three (3) years progressively responsible, professional experience related to the area of public finance, accounting, or treasury, including one (1) year of experience in treasury functions involving investments and cash management. One (1) year of lead or supervisory experience. Successful completion of PCC LEAD Academy or a comparable external leadership training program may substitute for up to 6 months of lead or supervisory experience.

Knowledge, Skills, and Abilities

Knowledge of:

- Supervisory principles;

- Financial principles and practices in assigned area of responsibility;

- Budgeting principles and practices;

- Applicable federal, state, and local laws, rules, regulations, and ordinances;

- Non-profit/college fund accounting systems and principles;

- Advanced internal control practices;

- Advanced financial analysis principles and methods;

- Research methods and techniques;

- Automated financial systems;

- Community college operations and administration principles and practices;

- Policy and procedure development and implementation practices.

Skills in:

- Supervising subordinate staff;

- Coordinating activities with other internal departments and/or external agencies;

- Developing and monitoring budgets;

- Interpreting and applying applicable federal, state, and/or local laws, rules, and regulations;

- Evaluating complex financial systems and efficiently formulating and installing accounting methods, procedures, forms, and records;

- Preparing complex financial statements, reports, and analyses.

Ability to:

- Work with diverse academic, cultural and ethnic backgrounds of community college students and staff;

- Develop and enforce finance and accounting procedures and principles;

- Analyze and interpret complex financial and accounting information;

- Design and implement finance, budgeting, accounting and recordkeeping systems;

- Manage projects;

- Prepare a variety of reports related to operational activities, including statistical analysis;

- Monitor compliance with applicable policies, procedures, rules, and regulations;

- Utilize computer technology for communication, data gathering and reporting activities;

- Communicate effectively through oral and written mediums.

Reviewed: 12/2018

Revised: 04/2010; 10/2014; 11/2022

Replaces: Treasury Analyst

Portland Community College is committed to hiring and retaining a diverse workforce. We are an Equal Opportunity Employer, making decisions without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disability, or any other protected class.