Your credit report

Your credit report contains information about you that banks, credit unions, and credit card companies are interested in seeing before lending you money. It includes your history of borrowing and paying back loans which may include student loans, a mortgage, credit cards, car loans, etc. It will show whether you pay your bills on time and how much you owe on your accounts. Poor fiscal management, such as late payments, bankruptcies, collections or liens, is included in a credit report and will impact your credit score. It may also include criminal records.

How do I get a copy of my credit report?

There are three nationwide credit reporting companies, Experian, Equifax, and TransUnion. By law, you are entitled to get a free copy of your credit report once a year from all three companies. You can get a free report online from AnnualCreditReport.com or by phone at 1-877-322-8228.

Credit score – why is it important?

Your credit score is a three-digit number that ranges from 250 to 900 based on the information in your credit report. Your credit score will affect whether or not you can get a loan and the interest rate you will pay when you carry a balance. With a high score, you are more likely to get a loan. A low credit score may disqualify you entirely, or you may have to pay a very high interest rate.

Credit scores may be used by a landlord to evaluate potential renters. Insurance companies also can use credit scores to determine rates. A high credit score typically leads to better rates and opportunities.

How credit scores are calculated

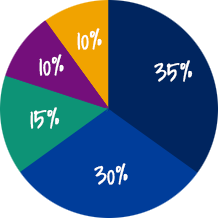

![]() 35% payment history:

35% payment history:

Paying on time increases the score. Late payments, bankruptcies, liens, and garnishments lower the score.

![]() 30% amounts owed:

30% amounts owed:

The percentage of the credit limit owed for each loan or credit card. A lower percentage owed on each card or loan will increase the score. Maxing out a credit card or loan will lower the score.

![]() 15% length of time of your credit history:

15% length of time of your credit history:

Older accounts increase the score because you have a long track record of paying on your debt, so avoid closing your oldest cards.

![]() 10% new credit:

10% new credit:

Applying for new credit lowers the score. However, if you apply for several credit options within a 60-day period, it only counts as one incident. It is assumed you are shopping for the best rate, and that is exactly what you should do if you are looking to open a new account.

![]() 10% types of credit:

10% types of credit:

Having a mix of different types of loans increases the score. For example, student loans, credit cards, and a mortgage.

How do I get a copy of my credit score?

To get your credit scores you can:

- Most credit cards offer free access to your credit score through partnerships with one of the three national credit bureaus.

- Buy it at MYFico.com. You may have three scores: one from each credit reporting company.

Beware of websites that advertise a free credit score. Some “free credit score” sites automatically sign you up for a credit monitoring service with monthly fees!

How can I improve my credit score?

Check for errors

Credit reports often contain mistakes. If there is negative information on your report that is inaccurate, you have the right to dispute it.

Write to the credit reporting company and dispute any errors

For more information on how to dispute errors on credit reports, see the Consumer Financial Protection Bureau.

Pay your bills on time

Paying your bills on time has the greatest impact on improving your credit score. You may want to set up automatic payments or pay your bills when they first arrive to avoid late payments. One overdue payment can really hurt your score.

Pay down your debt

Reducing the percentage of what you owe on credit cards and loans can boost your score. Pay down debt on accounts that have the highest interest rates and those closest to their credit limit. The goal is to have all loans/credit cards below 30% of their limit. Better yet, pay off your credit card debt every month and don’t carry a balance.

Keep at least one credit card that you pay off each month

Paying your entire balance each month will increase your score. Resist the urge to close all your credit cards, unless that is the only way you can control a spending habit. Try to keep the card you have had the longest and which also has the lowest interest rate and/or fees.

Beware of any organization that claims to “clean up” your credit for you! Remember that the only way to repair your credit is to pay down your bills over time.

What if I don’t have enough credit to have a credit score?

Establish credit. If you have not used credit cards or taken out loans you may not have enough credit history for a credit score. You will need to borrow to establish a credit history and credit score. If you are working and have an income you may be eligible for a credit card. Getting a credit card and using it sparingly will raise your credit score. Be sure to pay off the balance every month to avoid paying interest or going into debt. You do not need to pay interest to improve your credit score.

If you are not eligible for a regular credit card, you may want to get a secured credit card. You will need to put money into a savings account that will be equal to your credit limit on the secured card. Use your credit card carefully, always paying your bill on time. With a secured card you may need to pay an annual fee. To find the lowest annual fees and interest rates on a secured card, check your local credit unions or BankRate.com. You may also be able to have your parents co-sign on a credit card – ask at your bank for options.

Protect yourself from identity theft

Identity theft occurs when someone steals your identity and uses your personal information to commit crimes, such as obtaining a credit card or renting an apartment in your name, racking up charges on your credit card or other accounts, or withdrawing money from your bank account. Identity thieves can even get a driver’s license, or open utility or medical services in your name. You may not find out about these crimes until you notice money missing, or charges you didn’t make, or you may be contacted by a debt collector.

The best way to avoid identity theft is to safeguard your personal information and regularly monitor your personal accounts. For more information about identity theft and how to avoid it, visit the Federal Trade Commission’s Identity Theft Prevention site.